Are you wondering if the marketing investment to get more traffic, leads, and sales will pay off? The truth is, that most companies are still not measuring their marketing ROI. Even some of the largest companies are still focused on metrics pertaining to tactical work, rather than benchmarking efforts against a digital marketing ROI calculator. And how do you calculate inbound marketing strategy ROI?

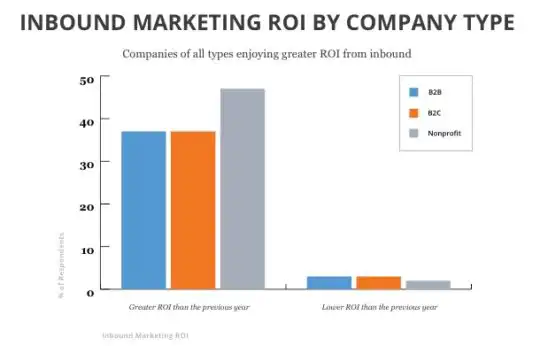

Globally, 41% of marketers confirm inbound produces measurable ROI, and 82% of marketers who blog see positive ROI for their inbound marketing.

Return on investment (ROI) is the most popular financial metric when you need to compare the attractiveness of one business investment to another. This is where top inbound marketing agencies can greatly help in terms of leveraging HubSpot closed-loop reporting to track the ROI of sales and outbound marketing efforts.

Your marketing ROI equals the present value proposition of your accumulated net benefits (gross benefits minus ongoing costs) over a specific time period, divided by your initial costs. It's expressed as a percentage over a certain amount of time; for this example, we will use the equation for a 3-year ROI:

(net benefit year 1 / (1+discount rate) + net benefit year 2 / (1+discount rate) + net benefit year 3 / (1+discount rate)) / initial cost

So, if the initial cost for your product is $100,000, your annual benefits minus annual costs are constant at $50,000 for the next three years, and the discount rate is 10%, your 3-year ROI would be:

($50,000 / (1 + .1) + $50,000 / (1 + .1)^2 + $50,000 / (1 + .1)^3)/$100,000 = 124%)

If that math is a bit much, see the inbound marketing ROI calculator on our site.

The main goal of the digital marketing ROI calculator is to allow you to gauge and forecast the marketing efforts in marketing agencies needed in order to meet your revenue goals. Potential customers should be able to quickly specify and change the variables that are important to them. The best way to achieve this is to use several dynamic sliders to change the variables that must be measured, such as:

- Number of records processed. This is a practical measure of productivity.

- Number of sales made, a practical measure to increase the effectiveness of the sale.

- Duration of customer service calls, a practical measure for more efficient customer service.

Other variables that are unique to each business are the salary of the target employees, the number of employees, and the number of transactions.

Close the offer at any point of your sales cycle

A well-designed inbound marketing ROI calculator can be used effectively at any point in the sales cycle. An inbound marketing calculator is a great tool to attract and qualify prospects. Place the Flash-based version on your website or on your laptop so that you can look through the model as you collect and store your preliminary thoughts. At the end of the session, you'll have excellent insight and a preliminary ROI figure that you can use in order to judge the value of the prospect.

The series of tasks that should be completed:

- Select the target customer segments and understand their needs.

- Select the financial metrics you want to use (ROI, NPV, IRR, etc.).

- Quantify the value of features and benefits in calculations.

- Determine assumptions and contributions.

- Determine default values for assumptions.

- Define default values for entries at each stage of your funnel or flywheel

- Determine the appropriate range for the upper and lower limits for each variable.

- Develop a professional-looking ROI calculator.

- Test and refine the inbound marketing calculator.

How does inbound marketing ROI affect your business?

If you're starting up a new business, then the knowledge of return on invested capital (ROIC) is very important. It's used to settle on the efficiency of the invested cash in the new business.

ROIC is calculated by dividing the net profit of your business by the entire sum of assets. The amount that's generated out of the calculation isn't the exact ROIC. Cash and investments are to be subtracted from the amount, as these aren't investments in your new business itself. What you get after the calculation is the ROIC from your marketing budget.

ROIC = (Net Profit/Total Assets) - Cash and Investments

Businesses are generally considered a riskier investment, and hence you must focus on having 20% to 30% of ROIC in order to win the interest of investors. If the ROI is low, it means that the shareholders aren't getting enough compensation for their risks.

If ROI is low:

- You must focus on purchasing assets but with a limit. The assets must be used productively in order to get more profit.

- Restrict yourself in spending too much cash on expenses, as it can lower profit and restrain growth goals. If you're holding cash in your business, then you're not using it effectively. This sort of safe investment results in a very low return.

- Paying off debt is making an investment, and the present rate of interest is around 6%. It's definitely better than holding it in the account of the money market.

- Having good ROI is essential in order for a new business to grow and flourish. Thus, you need to utilize your assets, funds, and cash effectively in order to enjoy good ROI. Keep your initial investment low and find a business that's in a high-growth industry.

The Short Version

The quick first steps to measuring inbound marketing ROI are:

- Average Monthly Visitors to Your Site – Use Google Analytics or a similar service in order to get this information. HubSpot has some of these resources built right into the platform.

- Average Leads per Month From Your Site – How many monthly leads are you generating through your site? More specifically, anyone who has provided his or her email address to you. That could be in return for downloading an ebook, subscribing to a newsletter, requesting a quote, etc.

- Percentage of Qualified Leads – Of those leads described in #2 above, what percentage of them are qualified to enter your sales process? If you’re not sure, guess to the nearest 25% in order to get started.

- Close Rate – What is your percentage of qualified leads who become customers? Again, if you’re not sure, guess to the nearest 25%.

- Customer Lifetime Value – What is the average lifetime value for a customer for your company? If a customer represents more than a one-time occurrence, add up what you make from a customer over the course of a relationship.

For instance, if you make $1,000 per customer each year, and you tend to keep customers an average of seven years, the customer lifetime value would be $7,000. As such, reducing churn rates will result in a large increase in your customer lifetime value and can change the entire trajectory of your sales growth.

Key Conclusions

“Half the money I spend on advertising is wasted; the trouble is, I don't know which half.” – John Wanamaker

When you start up your site, for a business, online or offline, all your plans and strategies are nothing but a calculated guess, a gamble where you try to minimize the chances of losing. Accurately projecting marketing ROI is an important tool that lets you do the same. Calculating your inbound marketing ROI at regular intervals is crucial to understanding the results that you achieve in your business. Our free HubSpot marketing ROI calculator will act as an appropriate guide for your company to help forecast potential to scale and the investment needed to make that happen successfully.

Use a free marketing ROI calculator as part of your sales process and make sure all customer information is saved. You can use the stored information in order to refine customer segmentation and improve the customer appraisal process. The stored information is also the basis for excellent customer case studies showing the realistic inbound marketing traffic needed in order to achieve this year's sales goals and projected growth rates.